BTC Price Prediction: $120K Target as Institutional Accumulation Meets Technical Breakout

#BTC

- Technical Breakout Potential: BTC needs to clear 116,045 USDT resistance to confirm bullish continuation

- Institutional Adoption: Corporate treasuries now hold over 3% of BTC's circulating supply

- Macro Tailwinds: US political developments reducing regulatory uncertainty

BTC Price Prediction

BTC Technical Analysis: November 2025 Outlook

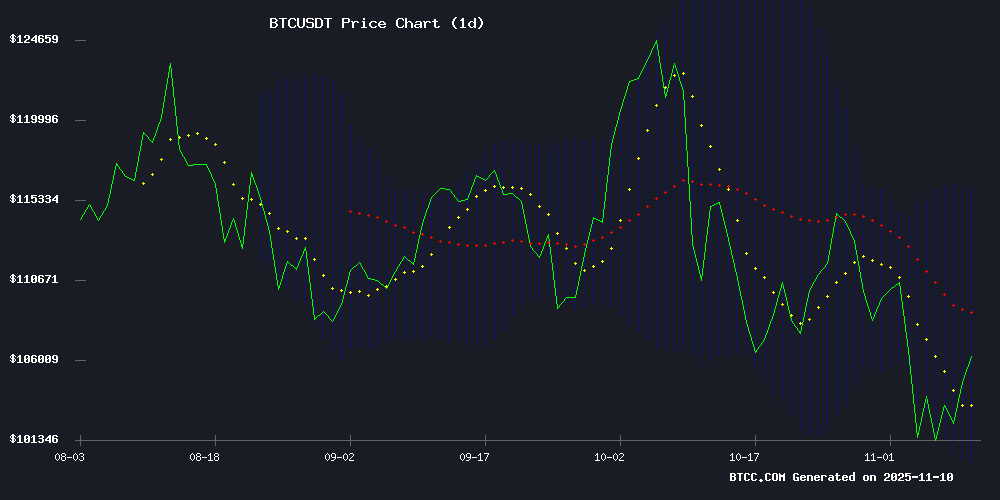

BTCC financial analyst Olivia notes that BTC is currently trading at, slightly below its 20-day moving average of, suggesting a potential consolidation phase. The MACD indicator shows bullish momentum with a positive histogram (), while Bollinger Bands indicate volatility with price hovering NEAR the middle band. A breakout above(upper band) could signal renewed bullish momentum.

Market Sentiment: Institutional Demand Fuels BTC Optimism

BTCC's Olivia highlights strong institutional interest as MicroStrategy addsto its treasury (now holding), while political developments (US Senate shutdown resolution) create favorable regulatory tailwinds. TheAI partnership between Rumble and Tether underscores growing crypto infrastructure adoption.

Factors Influencing BTC’s Price

iShares Bitcoin Trust (IBIT) Rebounds as Bitcoin Price Rises

The iShares Bitcoin Trust (IBIT) regained momentum, climbing 2.14% to $60.17 amid a broader Bitcoin rally. The cryptocurrency rose 1.19% to $105,936.34, fueled by institutional demand. MicroStrategy (MSTR) disclosed a $50 million securities sale to purchase 487 BTC, expanding its holdings to 641,692 coins. Separately, Strive acquired 1,567.2 Bitcoin at an average price of $103,315.46 over a 12-day period.

Despite the uptick, IBIT remains 1.53% lower over five trading days—though it maintains a 10.99% year-to-date gain. Analyst sentiment diverges sharply: TipRanks data shows 13 Bearish ratings against just 7 Bullish calls, resulting in a Strong Sell consensus. Retail interest appears steady, with 1.9% of tracked portfolios holding IBIT and investors aged 35-55 driving most activity.

Coinbase CEO Brian Armstrong: Crypto is Key to Economic Prosperity

Brian Armstrong, CEO of Coinbase, positions cryptocurrencies as a driving force behind global capitalism and economic freedom. Drawing parallels between economic systems and national outcomes, he contrasts Poland's capitalist-driven growth with Venezuela's socialist collapse. "The world needs more capitalism and less socialism to achieve prosperity," Armstrong asserts, framing crypto as a tool for financial liberation.

Armstrong highlights crypto's role in serving the unbanked and underserved populations, offering them a pathway to financial independence. His bullish outlook includes a prediction that Bitcoin could reach $1 million by 2030, fueled by escalating institutional demand. The Coinbase chief encourages widespread adoption, urging small businesses and individuals to engage with digital assets regardless of their current financial standing.

Strive Asset Management Raises $160M in Oversubscribed IPO to Boost Bitcoin Holdings

Strive Asset Management, co-founded by Vivek Ramaswamy, closed a $160 million IPO for its Variable Rate Series A Perpetual Preferred Stock (SATA) on Nasdaq. Investor demand forced the firm to increase its share offering from 1.25 million to 2 million shares, priced at $80 each. Ramaswamy personally acquired 15,625 shares, reinforcing confidence in the offering.

Proceeds will primarily fund Bitcoin acquisitions, signaling institutional commitment to cryptocurrency as a core asset. The capital raise coincides with Strive's all-stock acquisition of Semler Scientific, expanding its portfolio with strategic holdings. This move reflects growing Wall Street convergence with digital asset strategies.

Rumble and Tether Forge Alliance to Establish 'Freedom-First' AI Infrastructure

U.S. video platform Rumble has struck a deal to acquire Germany's Northern Data AG in a transaction valued at up to $967 million, accelerating its push into AI and cloud computing. The agreement grants Northern Data shareholders 2.0281 Rumble Class A shares per share, with an additional $200 million cash component contingent on the sale of Northern Data's Texas facility. The transaction, expected to close by mid-2026, follows Northern Data's divestiture of its Bitcoin mining operation and transfers 22,400 Nvidia GPUs to Rumble's infrastructure portfolio.

Tether emerges as a key financial architect in the deal, converting €305 million of its Northern Data loan into Rumble equity while committing to $150 million in GPU services procurement. The stablecoin issuer's earlier $775 million investment in Rumble now extends to a $100 million advertising pact promoting Rumble's cryptocurrency wallet and creator monetization tools. Rumble CEO Chris Pavlovski positions the move as a strategic counterweight to Big Tech's AI dominance, with the company holding 210 BTC among its $293.8 million liquidity reserves.

MicroStrategy Acquires Additional 487 BTC at $102,557, Boosting Holdings to 641K BTC

MicroStrategy, the enterprise software firm turned Bitcoin advocate, has added another 487 BTC to its treasury at an average price of $102,557 per coin. The $49.9 million purchase brings its total holdings to 641,692 BTC—a position now worth $47.54 billion with an average cost basis of $74,079 per bitcoin.

CEO Michael Saylor disclosed the acquisition via an X post and SEC filing on November 10, maintaining the company's trademark transparency. The transaction marks another milestone as MicroStrategy routinely executes buys above the $100,000 threshold. Year-to-date, the firm reports a 26.1% yield on its Bitcoin strategy.

This follows a 397 BTC purchase in late October, demonstrating relentless accumulation despite elevated prices. MicroStrategy's unwavering commitment continues to anchor institutional confidence in Bitcoin as a treasury reserve asset.

IREN Shares Waver Amid Mixed Reactions to Microsoft Deal Post-Q1 Earnings

IREN Limited's stock exhibited muted performance following its Q1 FY2026 results, initially rising 6% before paring gains. The Sydney-based data center operator, formerly focused on Bitcoin mining, now faces divergent analyst views on its $9.7 billion Microsoft partnership.

While Roth MKM's Darren Aftahi and Cantor Fitzgerald's Brett Knoblauch expressed optimism, the market reaction remained tepid. Canaccord Genuity's Joseph Vafi boosted his price target by 66% to $70, citing the deal's potential to position IREN favorably in AI infrastructure through GPU-powered workloads.

The company's shares had dropped nearly 7% post-earnings on Friday, reflecting investor uncertainty about its strategic pivot from cryptocurrency operations to AI-focused data services.

Best Crypto Presales to Buy Now as Bitcoin Rebounds to $105K: New Bull Run?

The cryptocurrency market has surged by 4.7% in the last 24 hours, adding $160 billion to its total capitalization. This influx of liquidity disproportionately benefits smaller altcoins, as their lower market caps allow for sharper price appreciation. Investors are increasingly turning to high-risk, high-reward plays, with presales emerging as a strategic entry point for early-stage projects.

Presales offer discounted access to tokens before exchange listings, creating opportunities for outsized gains. Among the notable offerings is Best Wallet Token, the native asset of a multichain wallet designed to simplify on-chain transactions. Unlike legacy wallets, it promises seamless cross-chain functionality and user-friendly features reminiscent of mainstream fintech apps.

Strategy Expands Bitcoin Treasury with $49.9 Million Purchase, Now Holds Over 3% of Supply

Strategy, the corporate Bitcoin holder formerly known as MicroStrategy, has added 487 BTC to its treasury at an average price of $102,557 per coin. The $49.9 million acquisition brings its total holdings to 641,692 BTC—a $68 billion position representing more than 3% of Bitcoin's total supply.

The purchase was funded through perpetual preferred stock offerings, continuing the company's five-year strategy of converting equity raises into Bitcoin exposure. Since 2020, Strategy has systematically accumulated BTC through capital markets activity, turning its balance sheet into what analysts call "a publicly traded Bitcoin proxy."

With paper gains exceeding $20.5 billion on its Bitcoin position, the company demonstrates how institutional adoption is reshaping cryptocurrency markets. The latest acquisition coincides with renewed corporate interest in Bitcoin as both inflation hedge and strategic asset.

Crypto Market Soars as Senate Votes to End US Government Shutdown: Best Altcoins to Buy Now

The cryptocurrency market has staged a remarkable recovery since October, when bearish sentiment dominated. A key catalyst emerged as the U.S. Senate passed a funding bill to end the 41-day government shutdown, sparking a broad-based rally. Bitcoin led the charge with a 4.4% surge to $106,300, while altcoins outperformed—20 of the top 100 cryptocurrencies by market cap gained 10% or more.

Market capitalization jumped 4.6% to $3.58 trillion as bipartisan progress in Washington eased macroeconomic uncertainty. Traders are now scrutinizing altcoins for opportunities, with momentum shifting decisively from fear to greed. The question isn't whether to buy, but what to buy—and how to position for what could be the start of a sustained uptrend.

Bitcoin Reclaims Key Technical Level as Political Catalysts Fuel Rally

Bitcoin surged 4.4% to $106,500, decisively reclaiming its 50-week moving average - a critical technical threshold that often demarcates bull and bear markets. The move comes amid renewed institutional interest and favorable US political developments, including progress on avoiding a government shutdown.

Market participants now speculate whether BTC can reach $120,000 before December. The rally follows months of macroeconomic uncertainty that had suppressed crypto valuations. Analyst Ash Crypto observes Bitcoin has gained 300% over five months when similar technical conditions appeared.

The Senate's shutdown resolution and stimulus speculation created immediate tailwinds. However, the House must still approve the measure before it reaches the President's desk. This political catalyst coincides with growing anticipation around Bitcoin Hyper, a new Layer 2 solution preparing for exchange listings.

US Senate Deal Could End Shutdown, Bringing Hope for Crypto Relief

The US Senate has reached a three-part budget agreement that may finally conclude the 40-day government shutdown. Political analysts suggest the legislation has sufficient support to pass the 60-vote threshold, with prediction markets now indicating a 54% probability of resolution by week's end.

Bitcoin's valuation has mirrored the political turbulence, retreating 17% from its October 6 peak of $126,080 to current levels near $104,370. The cryptocurrency's decline accelerated following President Trump's unexpected tariff announcement, which injected fresh volatility into global markets.

Market participants anticipate that resolving the shutdown could stabilize digital assets. The proposed $2,000 tariff dividend adds another layer of complexity, potentially influencing both traditional and crypto markets as liquidity dynamics shift.

Is BTC a good investment?

Based on current technicals and market catalysts, Olivia maintains a bullish 3-month outlook for BTC:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20D MA | -1.99% discount | Buying opportunity |

| MACD Histogram | +1,509.30 | Bullish momentum |

| Institutional Holdings | MicroStrategy: 641K BTC | Strong HODLing |

Key risks include potential profit-taking near 116,045 USDT resistance.

1